In a dramatic twist that captured global attention, Bitcoin (BTC) recently surged to an all-time high near $95,000 — but many investors are now asking:

Was this rally based on false hopes?

At the heart of the skepticism lies uncertainty surrounding the Trump-Xi tariff deal, a supposed breakthrough that fueled optimism across traditional and crypto markets alike. Now, cracks are starting to show. Let’s dive into what’s really happening. 🔎

🏛️ The Trump-Xi Tariff Deal: Hope or Illusion?

Reports initially suggested that former U.S. President Donald Trump and Chinese President Xi Jinping had reached a tentative agreement to ease long-standing trade tensions.

Markets — both traditional and digital — cheered the news, sending Bitcoin soaring alongside stocks and commodities.

But the details of the deal remain vague, unconfirmed, and largely speculative.

No formal documentation. No clear roadmap. Just political headlines and market optimism.

Now, doubt is creeping back in.

🧠 Why Investors Are Skeptical

Here’s why many analysts and investors believe the rally may have been built on shaky ground:

1. 📑 Lack of Concrete Details

Thus far, neither the U.S. nor China has officially disclosed the terms of the deal.

Without clarity, many view the agreement as more of a political statement than an enforceable trade pact.

2. 🧩 Complex Trade Dynamics

Tariffs and trade policies are deeply complex.

Even if some tariffs are rolled back, underlying tensions — like technology restrictions and geopolitical rivalries — remain unresolved.

This casts doubt on the long-term sustainability of any “agreement.”

3. 🌐 Global Macro Uncertainty

The global economy is still grappling with high inflation, supply chain disruptions, and central bank tightening.

A superficial trade truce may not be enough to offset broader economic headwinds, especially for speculative assets like Bitcoin.

📉 Could Bitcoin Retrace?

Some market analysts warn that Bitcoin’s euphoric rally to $95K might be overstretched if based purely on tariff deal hopes.

If the market realizes the deal lacks substance, we could see:

- Sharp corrections in Bitcoin and risk assets.

- Increased volatility as traders react to shifting headlines.

- Flight to quality assets like gold or cash equivalents.

Already, we’re seeing early signs of hesitation in crypto order books and derivatives markets. 📊

🔥 Counterpoint: The Bitcoin Bull Case

Not everyone is bearish.

Some argue that Bitcoin’s rally wasn’t only about the tariff deal. Other positive factors could be driving BTC upwards, including:

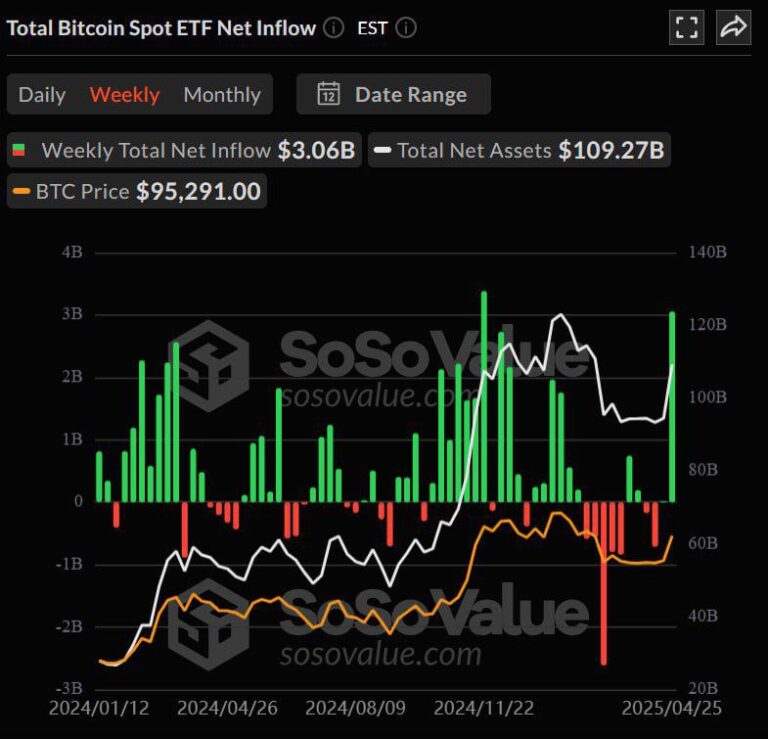

- Growing institutional adoption

- New spot Bitcoin ETFs attracting retail and professional money

- Ongoing macro distrust in fiat currencies and central banks

In this view, the tariff deal news might have accelerated Bitcoin’s momentum — but wasn’t the sole catalyst for its rise.

🧠 Final Thoughts

The truth is likely somewhere in the middle:

- Bitcoin’s rally to $95K was supercharged by optimism around the Trump-Xi news.

- But underlying macro trends and crypto-specific adoption are also major forces at play.

Still, investors should stay cautious.

If the market’s hopes about a true trade resolution prove unfounded, Bitcoin — like other risk assets — could face a sharp, emotional pullback.

As always in crypto: Hope for the best, but prepare for volatility. ⚡

🚀 Stay Informed, Stay Ahead

Crypto moves fast.

Markets change in an instant.

Stay connected to real-time news, analysis, and expert insights to navigate the Bitcoin rollercoaster like a pro!

👉 Follow us for more updates as the Bitcoin story unfolds. 📰