In what could be a game-changing move for the cryptocurrency industry, Cantor Fitzgerald has announced a massive $3 billion Bitcoin acquisition fund in collaboration with some of the most powerful players in the crypto world: SoftBank, Tether, and Bitfinex. According to a report from the Financial Times, this partnership aims to solidify Bitcoin’s position as a core asset in institutional portfolios and could spark a new wave of institutional adoption.

The head of Cantor Fitzgerald, Brandon Lutnick, has made it clear that the goal of this initiative is to replicate the highly successful crypto investment model pioneered by MicroStrategy, which has accumulated a significant Bitcoin reserve. But what does this partnership mean for the future of Bitcoin and the crypto market as a whole?

Let’s break down this groundbreaking announcement.

🚀 The $3 Billion Bitcoin Acquisition Fund: What We Know So Far

🌍 The Powerhouse Partnership

Cantor Fitzgerald, a leading global financial services firm, is teaming up with some heavyweight partners in this venture:

- SoftBank: A Japanese multinational conglomerate with an enormous investment portfolio, including stakes in major tech companies worldwide.

- Tether: The issuer of USDT, the world’s largest stablecoin by market cap, often used as a bridge currency in the crypto ecosystem.

- Bitfinex: A major cryptocurrency exchange that has been at the forefront of innovation in the digital asset space.

Together, these companies are bringing their vast experience, capital, and infrastructure to create a $3 billion fund dedicated to acquiring Bitcoin.

💰 The Objective

The core mission of this acquisition fund is to accumulate large quantities of Bitcoin (BTC) over time. This fund could significantly alter the market by consolidating substantial amounts of Bitcoin in the hands of a few key institutional players. The main aim is to:

- Provide Institutional Exposure to Bitcoin: By aggregating Bitcoin in large quantities, the fund offers a gateway for institutions to gain exposure to BTC without having to directly buy or store the assets themselves.

- Drive Bitcoin’s Institutional Adoption: This initiative could further validate Bitcoin as a legitimate asset class for large-scale investors, following in the footsteps of other institutional investors like MicroStrategy, Tesla, and Elon Musk.

- Offer a Strategic Investment Model: The goal is to replicate the successful strategy used by MicroStrategy’s Michael Saylor, who famously accumulated billions of dollars worth of Bitcoin as part of the company’s balance sheet.

🧠 Why Cantor Fitzgerald and Partners Are All-In on Bitcoin

1. A Proven Model of Success: MicroStrategy’s Bitcoin Strategy

Cantor Fitzgerald’s CEO, Brandon Lutnick, has openly stated that he aims to mirror MicroStrategy’s approach to Bitcoin. MicroStrategy’s strategy of accumulating Bitcoin has been extremely profitable for the company. Despite Bitcoin’s volatility, MicroStrategy’s holdings are up significantly, giving the company a substantial return on its Bitcoin purchases.

MicroStrategy has become one of the most notable examples of how traditional companies can integrate Bitcoin into their balance sheets and use it as a store of value. The company’s success has led other institutional investors to consider adopting similar strategies.

Lutnick and his partners at SoftBank, Tether, and Bitfinex are likely aiming to replicate that success by deploying a similar strategy on a much larger scale, with the $3 billion acquisition fund as a key vehicle.

2. A Strong Vote of Confidence in Bitcoin’s Long-Term Value

The involvement of SoftBank, Tether, and Bitfinex in this initiative is a clear vote of confidence in Bitcoin’s future as a store of value and a hedge against inflation. All three companies are deeply entrenched in the crypto world, and their participation signals that they believe Bitcoin has the potential to become a core asset in global financial markets.

For SoftBank, which has already invested heavily in the technology space, this partnership could offer a new avenue for growth. For Tether and Bitfinex, both of which are deeply integrated into the crypto ecosystem, this move further strengthens their commitment to Bitcoin as the leading cryptocurrency.

🔥 What This Means for the Crypto Market

1. Institutionalization of Bitcoin Continues

This announcement is yet another indication that Bitcoin is becoming an institutional asset class. The partnership between Cantor Fitzgerald, SoftBank, Tether, and Bitfinex shows that traditional finance and the crypto world are increasingly converging. As more large firms get involved in the space, Bitcoin will likely see increased legitimacy, further driving institutional demand.

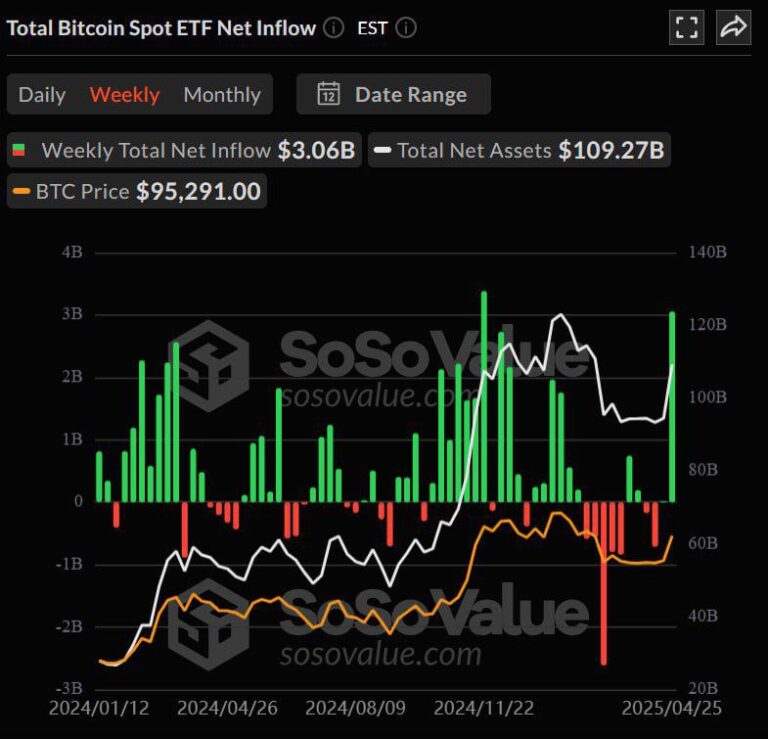

This could pave the way for more ETFs (Exchange-Traded Funds), futures contracts, and other financial products that provide exposure to Bitcoin. As institutional investors flood into the market, the liquidity, stability, and infrastructure around Bitcoin will improve, attracting even more traditional investors.

2. Potential for Increased Bitcoin Price Volatility

With $3 billion being funneled into Bitcoin, it could create upward pressure on the price, especially as this capital accumulates over time. This could result in significant price volatility, as large-scale buy orders could push the market in either direction. However, the long-term impact of such a fund will likely be positive for Bitcoin’s price, as it would further solidify Bitcoin’s position as a digital store of value.

3. A New Era for Crypto Investments

This massive acquisition fund could help usher in a new era for crypto investments, where traditional financial institutions and tech giants become more deeply involved in the digital asset space. For Bitcoin, this means even greater adoption and acceptance, not just as a speculative asset but as a fundamental part of a diversified investment portfolio.

🏁 Final Thoughts: The Bitcoin Bull Run Could Be Just Getting Started

Cantor Fitzgerald’s strategic collaboration with SoftBank, Tether, and Bitfinex represents a monumental move in the world of crypto. With a $3 billion fund aimed at acquiring Bitcoin, these institutions are making a strong statement about Bitcoin’s future in mainstream finance.

For institutional investors looking for ways to hedge against inflation and diversify their portfolios, Bitcoin continues to be a major focal point. As Cantor Fitzgerald’s fund begins its acquisition strategy, expect to see increased institutional adoption and a broader recognition of Bitcoin as a legitimate and profitable asset class.

With major players now doubling down on Bitcoin, it’s clear that Bitcoin’s bull market could be entering a new, exciting phase — and we may be witnessing the beginning of the next chapter in Bitcoin’s journey toward mainstream financial acceptance.

Stay tuned for more updates on institutional Bitcoin acquisitions and how this could shape the future of the crypto market!