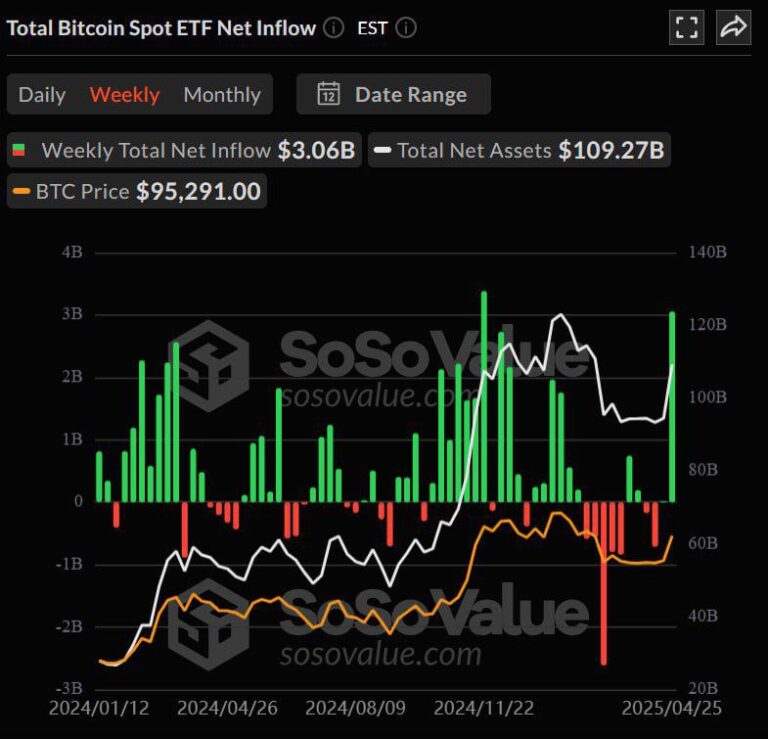

In the world of cryptocurrency, Exchange-Traded Funds (ETFs) are increasingly becoming a major point of focus, especially as they provide institutional investors with an easy, regulated entry point into the crypto market. The latest ETF flow data for April 22nd shows significant inflows into both Bitcoin (BTC) and Ethereum (ETH), signaling continued institutional confidence in these two market leaders.

Let’s dive into the numbers and explore what these movements mean for the broader crypto ecosystem.

🚀 ETF Flows: Bitcoin (BTC) Continues to Attract Institutional Capital

On April 22, 2025, Bitcoin ETFs saw a remarkable $912.7 million in net inflows, a clear sign that institutional investors are still flocking to the world’s largest cryptocurrency.

🧠 What Does This Mean?

The significant BTC inflows suggest that institutions are betting on Bitcoin’s long-term growth and stability. This influx of capital likely signals that investors view Bitcoin as a safe-haven asset, especially in light of recent economic uncertainties and rising inflation fears.

These institutional flows into Bitcoin ETFs are indicative of:

- Increased Institutional Adoption: The continued interest in Bitcoin ETFs reflects broader institutional interest in digital assets. With more investors now able to gain exposure to Bitcoin through traditional financial channels, Bitcoin is gaining legitimacy.

- Stronger Bullish Sentiment: This ETF buying activity could signal an underlying bullish sentiment in the market, with investors anticipating further price appreciation in Bitcoin over the coming months.

- Potential for Price Appreciation: Historically, large-scale institutional inflows have often been followed by upward price momentum. With $912.7 million entering the space, Bitcoin’s value could see further upward pressure in the near term.

🌐 Ethereum ETFs: $38.8 Million in Net Inflows

While Bitcoin continues to dominate, Ethereum is also benefiting from ETF interest. On the same day, Ethereum ETFs saw $38.8 million in net inflows, signaling that investors are also looking to capture the growth potential of ETH.

🧠 Why Is This Important for Ethereum?

Ethereum has long been seen as the second most important cryptocurrency, thanks to its smart contract capabilities and the growing popularity of decentralized finance (DeFi), non-fungible tokens (NFTs), and the Ethereum Virtual Machine (EVM). These factors make Ethereum an attractive asset for institutional investors who are looking to diversify their portfolios with altcoins.

Here’s what these ETF inflows mean for Ethereum:

- Rising Institutional Interest: While Bitcoin remains the dominant player, Ethereum’s rise in ETF flows indicates a growing recognition of Ethereum’s utility in the Web3 space and its upcoming upgrades like Ethereum 2.0 and the shard chains.

- Continued Growth for DeFi: As DeFi applications and smart contracts continue to thrive on the Ethereum network, institutional investors are likely betting that ETH’s value will rise as more projects build on its blockchain.

- Potential for Significant Growth: Ethereum’s long-term potential, driven by innovations in scaling solutions and Ethereum’s transition to Proof of Stake (PoS), makes it an appealing investment for those looking to capitalize on blockchain evolution.

💡 The Bigger Picture: ETF Flows and What They Tell Us About Market Sentiment

1. Institutional Confidence in Crypto

The fact that both Bitcoin and Ethereum saw substantial ETF inflows on April 22nd highlights growing institutional confidence in the cryptocurrency market. With BTC seeing almost $913 million in net inflows, and ETH drawing $38.8 million, institutions are sending a clear message: crypto is becoming an essential part of their portfolios.

2. ETF Investment Vehicle Increasingly Popular

ETFs are proving to be an essential tool for institutions and retail investors alike. These vehicles allow for easy access to crypto assets within regulated markets, bypassing the need for direct purchases of digital assets. This increase in ETF investment could be one of the primary drivers of the next bull cycle, especially as more ETFs launch for other cryptocurrencies.

3. Market Maturation

As the market matures and institutions become more involved, ETFs play a crucial role in bridging the gap between the traditional financial system and the world of crypto. The continued rise in ETF investments signals that crypto is no longer a niche investment but is increasingly being integrated into mainstream finance.

🔮 Looking Ahead: What’s Next for BTC and ETH?

With April 22nd’s massive ETF flows signaling a high level of interest in both Bitcoin and Ethereum, the market is on the cusp of a potential breakout. Here are a few things to watch:

- Bitcoin’s Price Action: Will the $912.7 million in Bitcoin ETF inflows lead to a further price surge? Many analysts predict that if Bitcoin crosses key resistance levels, the price could push even higher, potentially breaking the $100,000 mark.

- Ethereum’s Growing Use Cases: With Ethereum’s network upgrades, ETH’s appeal could expand further. If Ethereum continues to scale successfully, especially with Layer 2 solutions and its upcoming shard chains, Ethereum could see more ETF inflows, potentially leading to significant price increases.

- Altcoin ETF Adoption: Beyond Bitcoin and Ethereum, more altcoins might see ETF products launched as the market matures. This could create a broader rally in the crypto space, driven by institutional interest in projects like Solana (SOL), Polkadot (DOT), and Avalanche (AVAX).

🚀 Final Thoughts: The Growing Influence of ETFs on the Crypto Market

The strong ETF flows into both Bitcoin and Ethereum reflect a maturing market that is increasingly attracting institutional investors. With $912.7 million flowing into Bitcoin and $38.8 million into Ethereum on April 22nd alone, it’s clear that cryptocurrency is becoming a mainstay in the institutional portfolio.

As more investors continue to flock to ETFs for exposure to these leading digital assets, the next bull market could be on the horizon. If Bitcoin and Ethereum continue to show strength, we could be looking at an exciting time ahead for both investors and the crypto ecosystem.

Stay tuned for more updates on ETF inflows and how they impact the crypto market!