In an era where fiat currencies are increasingly subject to inflation, debt crises, and geopolitical instability, Bitcoin continues to gain traction as a safe haven asset. Now, a bold prediction from the CEO of Europe’s largest Bitcoin treasury is turning heads across the financial world: Bitcoin could reach $5–10 million within the next 20 years and become the world’s primary store of value.

This isn’t just another speculative forecast from a crypto influencer. This comes from a titan of industry, someone who oversees a multi-billion-dollar treasury with a core focus on BTC. Let’s break down what this prediction means, what’s driving it, and how Bitcoin could truly become the “digital gold” for the global economy.

🔍 Who Made This Prediction?

The claim comes from the CEO of Europe’s largest Bitcoin treasury, a financial powerhouse that holds a significant amount of BTC as part of its long-term strategic reserves. Although the identity of the CEO wasn’t publicly disclosed in this quote, the most likely suspect is Jan Wuestenfeld, or another executive closely associated with companies like MicroStrategy Europe, 21Shares, or Bitpanda’s institutional arm—all of which are known for their heavy involvement in crypto asset management.

Whoever it is, their words carry serious weight in the institutional investment world.

“Bitcoin has the potential to become the ultimate store of value — a monetary anchor for a digital-first global economy. We’re talking about $5 to $10 million per coin within two decades.”

— CEO of Europe’s Largest Bitcoin Treasury

Let’s unpack this bold claim.

💡 What Is a Store of Value?

A store of value is anything that maintains its value over time without depreciating. Traditional stores of value include:

- Gold

- Real estate

- Fine art

- Bonds (to some extent)

For centuries, gold has reigned supreme in this category. But in the digital age, Bitcoin is emerging as a powerful contender. Why? Because Bitcoin has characteristics that traditional stores of value simply can’t match:

- Finite supply: Only 21 million BTC will ever exist.

- Decentralization: No government or institution can control it.

- Portability: You can carry $1 billion worth of BTC in your pocket or your head.

- Transparency: Every transaction is logged on a public ledger.

📈 Why $5–10 Million BTC Is Not as Crazy as It Sounds

To understand how Bitcoin could reach such sky-high valuations, we need to look at macro trends, adoption rates, and monetary policy shifts.

1. Global Store of Value Market is Huge

Gold’s market cap is currently around $13 trillion. But if we broaden the category to include real estate, sovereign wealth funds, government bonds, and even art, the total store of value market exceeds $400 trillion.

If Bitcoin captures even 5–10% of this market, we’re talking multi-million dollar BTC.

Let’s do some back-of-the-napkin math:

- 5% of $400T = $20T

- $20T / 21M BTC = ~$950,000/BTC

- 10% of $400T = $40T = ~$1.9M/BTC

So, if the store-of-value thesis plays out and BTC adoption continues to grow, $5–10 million isn’t unrealistic — especially considering inflation-adjusted values over 20 years.

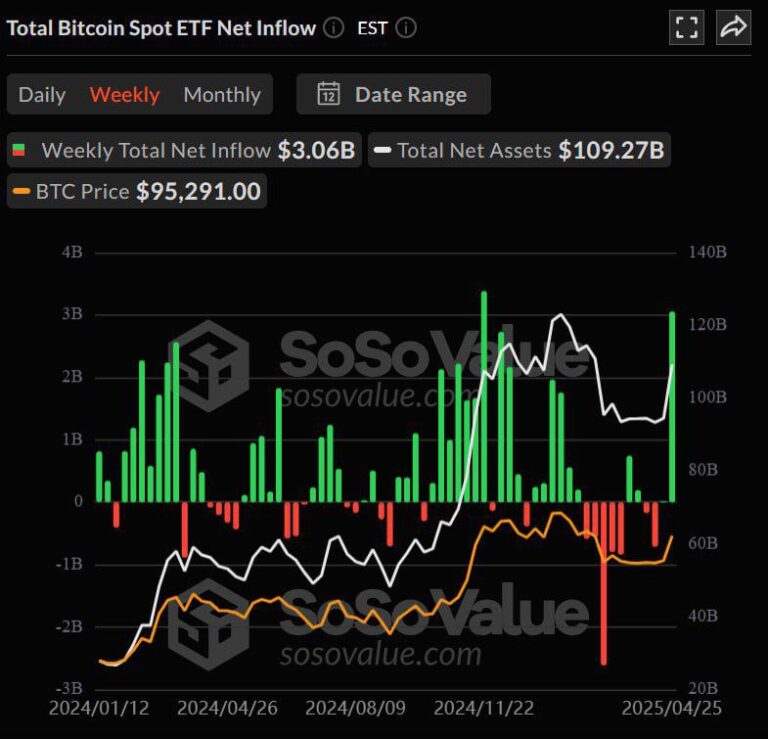

2. Institutional Adoption is Accelerating

We’re seeing massive capital inflows from:

- Hedge funds (BlackRock, Fidelity, ARK Invest)

- Sovereign wealth funds (rumored in the Middle East and Asia)

- Public companies like Tesla, MicroStrategy, and Square

As regulatory clarity increases, Bitcoin is becoming “safe enough” for traditional institutions. As these entities allocate even 1–2% of their portfolios to BTC, supply shock sets in, pushing price upward.

3. The Bitcoin Halving Cycle

Bitcoin’s supply issuance halves every 4 years. This programmed scarcity has historically preceded major bull runs:

- 2012 Halving → $12 to $1,100

- 2016 Halving → $650 to $19,700

- 2020 Halving → $8,600 to $69,000

- 2024 Halving → ???

If this pattern continues and is amplified by institutional demand, the next two decades could see exponential price appreciation.

🧠 Bitcoin vs Gold: The Digital Gold Thesis

The CEO’s prediction leans heavily on the idea that Bitcoin will supplant gold as the preferred store of value. Let’s compare:

| Feature | Bitcoin | Gold |

|---|---|---|

| Supply Cap | 21 million | Unknown |

| Portability | Instant (digital) | Physical transport |

| Divisibility | 1 BTC = 100M sats | Difficult |

| Verification | On-chain, instant | Requires assay |

| Inflation Proof | Yes (coded) | Historically yes |

Bitcoin offers a superior value proposition for a digital-first world. If millennials and Gen Z continue to accumulate wealth, it’s natural they’ll favor Bitcoin over gold, driving long-term demand.

🏦 Central Bank Digital Currencies (CBDCs) & Bitcoin’s Role

As more countries explore CBDCs, Bitcoin’s decentralized nature becomes even more attractive.

CBDCs will allow governments to control:

- Interest rates on your savings

- Expiration dates on money

- Where money can be spent

In this environment, Bitcoin becomes the “freedom money” — a censorship-resistant alternative. This further strengthens its position as a monetary anchor for individual sovereignty and global finance alike.

🌎 Global De-Dollarization: Another Tailwind for BTC

Countries like China, Russia, Iran, and Brazil are actively seeking alternatives to the US dollar for international trade. While they may prefer their own national currencies or gold, Bitcoin is emerging as a politically neutral option for:

- Cross-border settlements

- Sanction evasion

- Wealth preservation

If this de-dollarization trend continues, Bitcoin could become a neutral settlement layer — giving another massive boost to its perceived value.

💬 What the Critics Say

Not everyone agrees with the CEO’s forecast. Common counterarguments include:

- Bitcoin is too volatile to be a store of value

- Regulatory risks still loom large

- Quantum computing could threaten BTC’s cryptography

- Governments won’t allow a non-sovereign money to thrive

While valid, these criticisms are increasingly being addressed:

- Volatility decreases as adoption rises.

- Regulation is becoming more favorable in many jurisdictions.

- Bitcoin devs are working on post-quantum cryptography.

- Governments like El Salvador are already embracing BTC.

📣 Final Thoughts: Bitcoin at $10 Million?

Whether you’re a hodler, skeptic, or curious observer, one thing is clear: Bitcoin is on a trajectory no one can ignore.

The idea of Bitcoin reaching $5–10 million per coin sounds fantastical today — just as $60,000 sounded insane in 2013 when BTC was trading under $100.

If Bitcoin truly becomes the world’s dominant store of value, then this prediction could one day seem conservative.

“First they ignore you, then they laugh at you, then they fight you, then you win.”

— Mahatma Gandhi

In the end, the question isn’t “Can Bitcoin reach $10 million?”

It’s “What happens to the world if it does?”

🔑 Key Takeaways

- The CEO of Europe’s largest Bitcoin treasury predicts BTC could reach $5–10 million in 20 years.

- Bitcoin is increasingly seen as a digital store of value, with characteristics superior to gold.

- Institutional adoption, global de-dollarization, and macroeconomic instability are strong tailwinds.

- This isn’t just hype — it’s a monetary revolution in slow motion.

🚀 Ready to Ride the Bitcoin Wave?

Whether you’re a long-term investor or just starting out, now is the time to learn, prepare, and position yourself. The next 20 years could redefine what money means — and Bitcoin might be at the center of it all.