The crypto markets are heating up once again, and Bitcoin (BTC) is leading the charge!

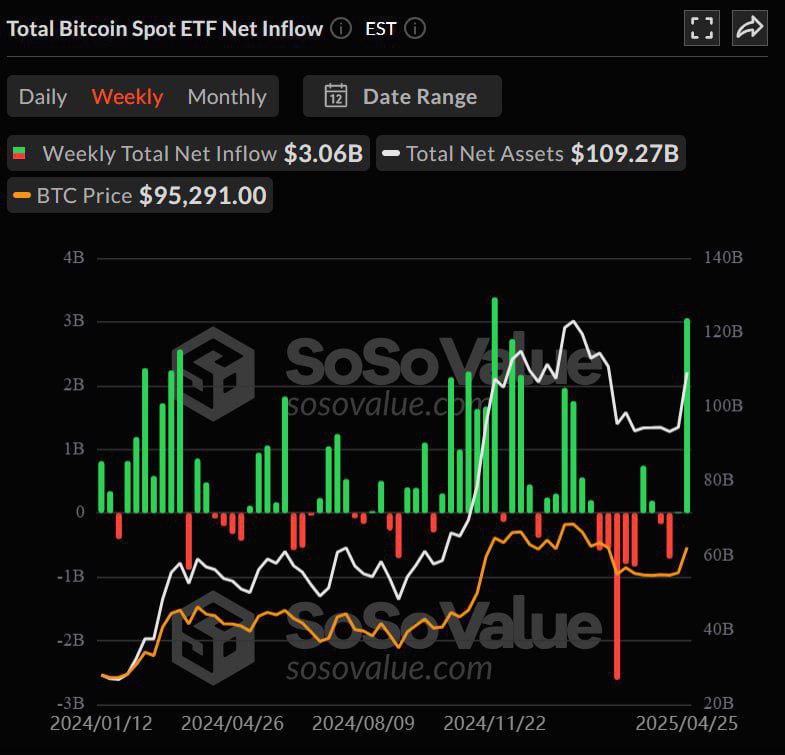

Last week alone, spot Bitcoin ETFs recorded a staggering net inflow of over $3 billion — numbers we haven’t seen since the post-Trump election Bitcoin buying frenzy! 🇺🇸🔥

This massive surge highlights just how much institutional interest in Bitcoin has reignited, even as Ethereum (ETH) ETFs start gaining traction.

💥 Bitcoin ETFs Break New Records

Bitcoin’s recent ETF performance is nothing short of historic:

- $3 billion+ net inflow in just seven days.

- Buying pressure comparable to late 2016 and early 2017, when Bitcoin’s bull market exploded after Donald Trump’s election win.

- Renewed confidence from both retail and institutional investors.

These inflows suggest that Bitcoin is no longer just a speculative asset — it’s increasingly viewed as a mainstream investment class alongside gold and stocks.

🌐 What’s Driving the Bitcoin ETF Boom?

Several factors are fueling Bitcoin’s massive ETF inflows:

- Macroeconomic Uncertainty

Inflation concerns, interest rate speculation, and geopolitical tensions are pushing investors toward alternative assets. - Growing Institutional Adoption

Big players like BlackRock, Fidelity, and Grayscale are making Bitcoin more accessible through regulated, trusted ETF products. - Political Winds Shifting

With U.S. elections approaching and Trump gaining momentum, many believe a pro-crypto administration could further legitimize Bitcoin. - Scarcity Narrative

Bitcoin’s fixed supply is becoming more attractive as fiat currencies face devaluation fears.

All these drivers are converging to create a perfect storm for Bitcoin demand. ⚡

🪙 Ethereum ETFs Gaining Steam — But BTC Leads the Race

Meanwhile, spot Ethereum ETFs also had a strong week, recording a net inflow of $157 million.

While this is impressive for ETH — and signals growing institutional appetite for Ethereum’s smart contract ecosystem — it’s clear that:

- Bitcoin remains the heavyweight champion among institutional investors.

- BTC still carries the “digital gold” narrative, making it a first choice for conservative and large-scale investors.

That said, Ethereum’s future looks bright, especially with upcoming network upgrades and the rising popularity of decentralized finance (DeFi) and NFTs.

🧠 What This Means for Investors

The latest inflow data shows one thing very clearly:

Crypto is entering a new era of institutional adoption.

Whether you’re a Bitcoin maximalist, an Ethereum enthusiast, or a diversified crypto investor, now is a pivotal time to:

- Stay informed about ETF movements.

- Understand macro and political trends impacting crypto.

- Position yourself for the next leg of growth.

Because when the institutions move in, the retail gains often follow. 🚀

🌟 Final Thoughts

The $3 billion Bitcoin ETF inflow is not just a number — it’s a massive vote of confidence in crypto’s future.

And with Ethereum ETFs gaining ground too, the stage is set for an exciting second half of 2025.

Will Bitcoin break new all-time highs?

Will Ethereum close the gap?

One thing’s for sure:

The smart money isn’t waiting — and neither should you.

👉 Stay tuned for more updates and insights as crypto’s next big chapter unfolds! 📚