As Bitcoin surges toward the $95,000 mark, many traders are asking the same question: When will altcoins catch up?

While Bitcoin’s rally has been making headlines, altcoins have remained relatively stagnant. But according to leading analysts, this dynamic is about to shift — and it could be the perfect storm for altcoins to explode.

Let’s break down why Bitcoin’s climb needs to cool off before the altcoin rally kicks off, and what signs suggest altseason could be just around the corner.

🚀 Bitcoin’s Ascent to $95K: A Bullish Signal with Side Effects

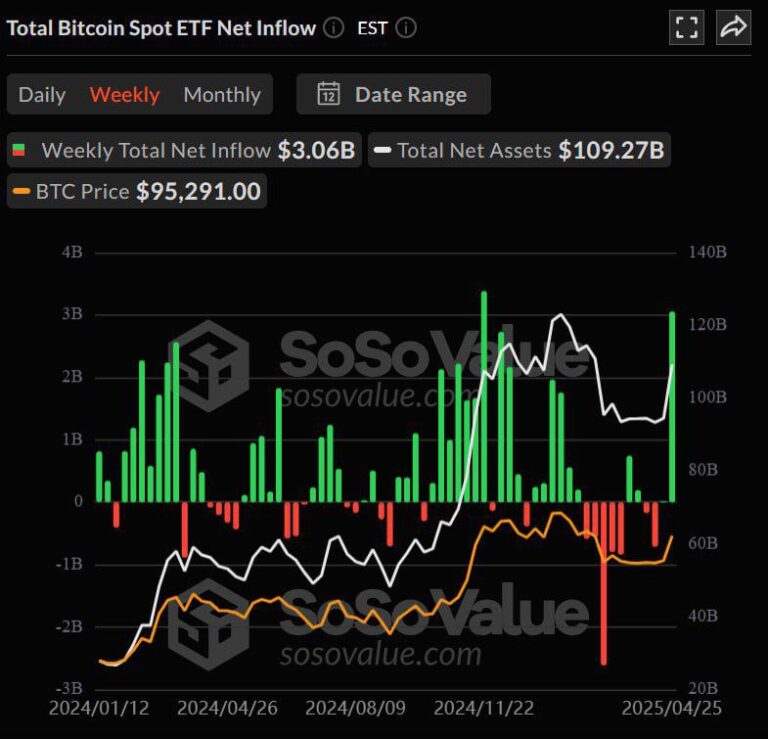

The crypto king is on fire. With bullish momentum fueled by institutional inflows, ETF demand, and macroeconomic uncertainty, Bitcoin is approaching the $95,000 level — a psychological milestone that seemed unthinkable just a few months ago.

But here’s the kicker:

While Bitcoin moonshots, altcoins are barely moving.

Why?

💡 The Bitcoin Dominance Factor

One of the biggest reasons altcoins haven’t popped yet is due to Bitcoin Dominance (BTC.D) — a metric that measures Bitcoin’s share of the total crypto market cap.

When Bitcoin dominance rises:

- Investors are pouring capital into BTC as a “safe bet”

- Altcoins tend to bleed or stay flat

- Retail interest remains narrowly focused on Bitcoin

But when dominance starts to fall, that capital often flows into alts — marking the beginning of altseason.

Currently, BTC dominance is peaking… and that’s exactly what analysts are watching.

🧠 What Analysts Are Saying

Crypto market analysts like Credible Crypto, Benjamin Cowen, and Michael van de Poppe have all echoed a similar thesis:

“Altseason doesn’t start when Bitcoin is pumping. It starts when Bitcoin stabilizes after a major move.”

Here’s why this is critical:

- During a Bitcoin surge, investor attention is monopolized

- Once BTC consolidates (or cools down), traders look for higher risk/reward opportunities

- That’s when altcoins like ETH, SOL, AVAX, and others start popping

In essence, Bitcoin leads, altcoins follow — and we’re almost at the turning point.

🌪️ Why This Is the Perfect Storm for Altcoins

As Bitcoin cools off near $95K, a few key macro and market factors are converging to form the ideal conditions for an altcoin explosion:

✅ 1. Bitcoin is Topping Out (Temporarily)

When BTC enters sideways consolidation, it creates a window of opportunity for altcoins to shine. This has happened in every previous cycle — and we’re seeing early signs of that again.

✅ 2. Liquidity Rotation is Starting

Institutional capital often starts in BTC and ETH — but eventually trickles down into mid- and low-cap alts. With liquidity now entering crypto at scale, altcoins are next in line.

✅ 3. Retail FOMO is Brewing

Bitcoin’s rally is drawing mainstream attention — but once new investors realize BTC might be “too expensive,” they turn to cheaper alternatives like:

- $SOL

- $ADA

- $DOGE

- $PEPE

- $RUNE

This is a psychological trigger that historically kicks off retail-driven alt rallies.

✅ 4. On-Chain Activity is Surging

Several networks like Solana, Base, and zkSync are seeing:

- New wallet creation

- Token launches

- DeFi activity

- NFT market rebounds

This uptick in on-chain metrics is a strong precursor to altcoin momentum.

📊 What Is Altseason – and How Do You Know It’s Here?

Altseason is a period where altcoins outperform Bitcoin — usually by a wide margin. This happens when:

- Bitcoin dominance drops rapidly

- ETH/BTC pair rises

- Small caps start doing 2x, 3x, even 10x gains in a short time

- Twitter and Telegram are flooded with “X just did a 5x” posts

You’ll know altseason is here when everything but Bitcoin is green, and your old meme coins suddenly come back to life.

🔍 Signs to Watch for an Incoming Altseason

Here’s what savvy traders are monitoring right now:

| Indicator | Signal |

|---|---|

| BTC Dominance | Peaking or reversing |

| ETH/BTC Ratio | Rising |

| Social Media Trends | Shifting to alts |

| DEX Volume | Spiking (especially on alt L1s) |

| Gas Fees | Rising (sign of high activity) |

🧭 How to Position Yourself for Altseason

If you believe altseason is near, here are a few smart strategies:

💰 1. Diversify Into Strong Alt Projects

Look for altcoins with:

- Real use cases

- Active devs

- Healthy ecosystems (TVL, volume, users)

Examples: $ETH, $SOL, $LINK, $ARB, $OP, $PYTH

📊 2. Watch BTC’s Movement Closely

Altcoins will not move until BTC slows down. Watch for:

- Sideways consolidation

- Dominance reversal

- Volume shifts to ETH and smaller coins

📈 3. Use DCA + Take Profit Strategy

Don’t go all-in. Use dollar cost averaging (DCA) to enter and set targets to take profits as alts pump. Altseasons are explosive — and they don’t last forever.