The Altcoin Abyss: Why Only 3 of 27 Binance-Listed Tokens in 2025 Are in the Green

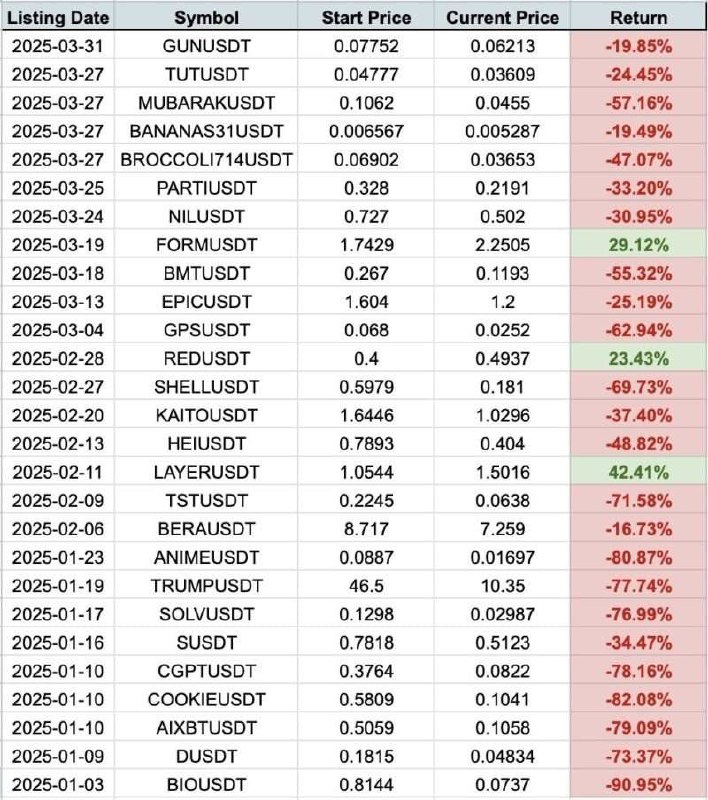

The altcoin market is bleeding, and the numbers don’t lie. Since the start of 2025, Binance—one of the world’s largest crypto exchanges—has listed 27 new tokens. Shockingly, only three are showing a positive return. That’s an 11% success rate, a grim statistic for investors betting on the next big thing. What’s driving this carnage, and why is the altcoin market losing its luster? Let’s dive into the murky waters of tokenomics, market manipulation, and centralized exchange blind spots.

The Numbers Paint a Bleak Picture

Binance’s new listings are often seen as a golden ticket for projects, a chance to ride the hype and attract liquidity. But the reality in 2025 is far from rosy. With just three tokens out of 27 holding their value, the altcoin market is starting to feel like a rigged casino. Investors are left wondering: why are so many projects tanking shortly after launch?

The answer lies in a toxic cocktail of market dynamics and questionable practices. According to Arthur Cheong, founder of DeFiance Capital, the root cause is the cozy relationship between token projects and market makers. These players, tasked with ensuring liquidity and price stability, hold immense power. When incentives misalign, they can orchestrate dumps that crater token prices by 70%—or even 90%—in a matter of days.

Market Makers: The Puppet Masters?

Market makers are supposed to stabilize markets, not burn them to the ground. Yet, as Cheong points out, some exploit their role to devastating effect. By controlling large token allocations, they can prop up prices during a listing’s honeymoon phase, only to pull the rug when it suits their profit motives. The result? Retail investors, lured by the promise of mooning prices, are left holding worthless bags.

This isn’t just a hypothetical. The data backs it up: 24 of Binance’s 27 new tokens are underwater, many plummeting to fractions of their listing price. These aren’t gentle corrections; they’re deliberate dumps that wipe out trust and capital in equal measure.

Centralized Exchanges: Willfully Blind?

You’d think centralized exchanges like Binance would step in to protect their users. After all, their reputation hinges on offering credible projects. But here’s the kicker: they’re turning a blind eye. Whether it’s lax due diligence, conflicting incentives, or simply prioritizing listing fees, exchanges seem content to let the chaos unfold.

This negligence has consequences. The altcoin market, once a hotbed of innovation, now feels like a graveyard of broken dreams. Investors are growing wary, and trust is eroding. If exchanges don’t tighten their standards, they risk alienating the very users who fuel their platforms.

The Bigger Picture: A Crisis of Confidence

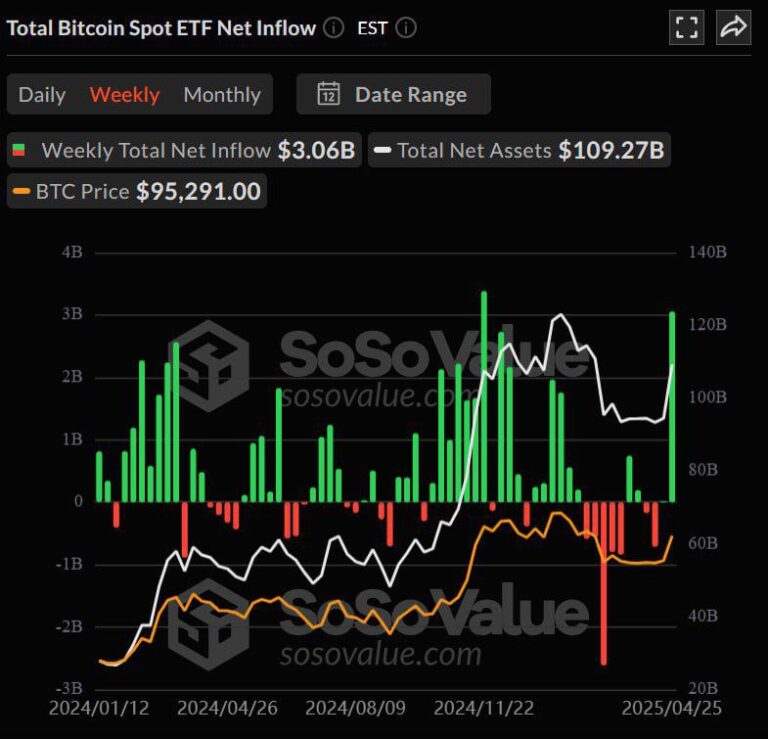

The altcoin market’s woes extend beyond Binance. Across the crypto ecosystem, skepticism is mounting. Projects that once promised decentralized utopia are now tainted by accusations of manipulation and greed. When market makers can tank a token by 90% without repercussions, it’s no wonder retail investors are fleeing to safer assets like Bitcoin or stablecoins.

This crisis of confidence threatens the entire DeFi narrative. If altcoins can’t deliver sustainable value, the dream of a decentralized financial system starts to look like a mirage. The industry needs a reckoning—better governance, stricter listing criteria, and accountability for market makers who play fast and loose with investor funds.

Can the Altcoin Market Recover?

It’s not all doom and gloom. The three tokens still in the green prove that quality projects can thrive, even in a bearish climate. But they’re the exception, not the rule. For the altcoin market to regain its footing, a few things need to happen:

- Transparency in Tokenomics: Projects must disclose market maker agreements and vesting schedules upfront. No more hidden dumps.

- Exchange Accountability: Binance and other platforms need to vet listings rigorously, prioritizing long-term viability over short-term hype.

- Community Vigilance: Investors should demand better. Due diligence isn’t just for institutions—retail traders need to scrutinize projects before jumping in.